Essay

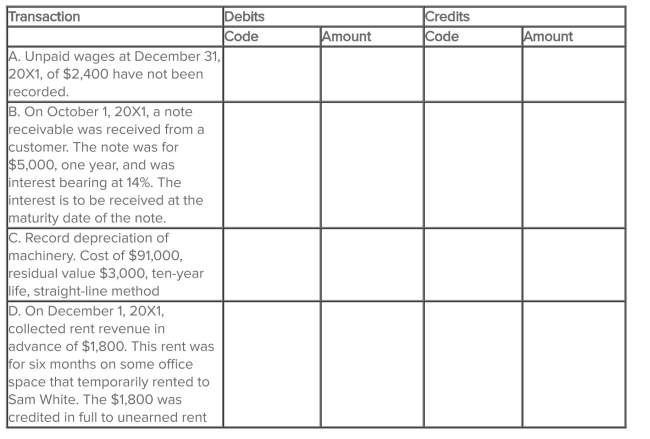

Settler Service is completing the information processing cycle at the end of its annual accounting period, December 31, 20X1. Four adjusting entries must be made to update the accounts. The following accounts, selected from the company's chart of accounts, are to be used for this purpose. They are coded to the left for easy reference. You are to indicate the appropriate account code and amount for each required adjusting entry at December 31, 20X1.

Correct Answer:

Verified

Please review the following information:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Joe Company purchased supplies inventory for $5,000.

Q104: Which of the following is one of

Q105: The statement of cash flows is designed

Q106: This question focuses on the accounting cycle

Q107: On December 1, 20X1, Widow Company paid

Q109: On January 1, 20X1, Thomas Company

Q110: Which of the following accounts would most

Q111: Amortization expense is an example of the

Q112: At the end of 20X4, Dallas

Q113: On June 1, 20X1, Global Services,