Multiple Choice

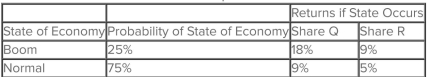

What is the standard deviation of a portfolio that is invested 40% in share Q and 60% in share R?

A) 0.7%

B) 1.4%

C) 2.6%

D) 6.8%

E) 8.1%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q72: The dominant portfolio with the lowest possible

Q75: Standard deviation measures _ risk.<br>A)total<br>B)nondiversifiable<br>C)unsystematic<br>D)systematic<br>E)economic

Q77: A share with a beta of zero

Q78: A portfolio is:<br>A)a group of assets, such

Q79: Kurt's Adventures SA equity is quite cyclical.In

Q80: If investors possess homogeneous expectations over all

Q81: Share A has an expected return of

Q99: The beta of a security is calculated

Q100: Total risk can be divided into:<br>A)standard deviation

Q117: The measure of beta associates most closely