Multiple Choice

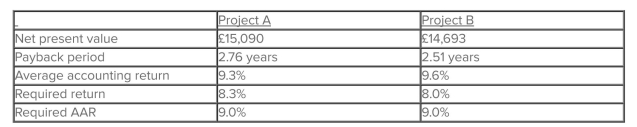

Matt is analyzing two mutually exclusive projects of similar size and has prepared the following data. Both projects have 5 year lives.

Matt has been asked for his best recommendation given this information. His recommendation should be to accept:

A) project B because it has the shortest payback period.

B) both projects as they both have positive net present values.

C) project A and reject project B based on their net present values.

D) project B and reject project A based on their average accounting returns.

E) project B and reject project A based on both the payback period and the average

Accounting return.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The payback period rule is a convenient

Q56: You are considering the following two

Q57: An investment project has the cash flow

Q58: When the present value of the cash

Q59: A £25 investment produces £27.50 at the

Q60: Martin is analyzing a project and has

Q63: You are analyzing a project and

Q64: The Winston Co. is considering two mutually

Q65: Jack is considering adding toys to his

Q66: You are trying to determine whether to