Multiple Choice

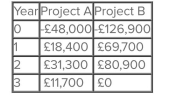

You are considering the following two mutually exclusive projects that will not be repeated. The required rate of return is for project and for project . Which project should you accept and why?

A) project A; because its NPV is about £335 more than the NPV of project B.

B) project A; because it has the higher required rate of return.

C) project B; because it has the largest total cash inflow.

D) project B; because it returns all its cash flows within two years.

E) project B; because it is the largest sized project.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: An investment is acceptable if its IRR:<br>A)

Q100: The shortcoming(s) of the average accounting return

Q101: The internal rate of return (IRR): I.rule

Q102: The discounted payback rule states that you

Q103: If a project has a net present

Q105: An investment is acceptable if the profitability

Q107: You are considering two independent projects

Q108: An investment's average net income divided by

Q109: An investment is acceptable if its average

Q110: You are considering the following two