Essay

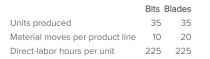

Forrest Company manufactures sophisticated industrial drill bits and saw blades used in heavy construction projects.The company is now preparing its annual profit plan.As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information.  The total budgeted material-handling cost is $75,000. Required: 1.Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2.Answer the same question as in requirement 1, but for mirrors. 3.Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves. 4.Answer the same question as in requirement 3, but for mirrors.

The total budgeted material-handling cost is $75,000. Required: 1.Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2.Answer the same question as in requirement 1, but for mirrors. 3.Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves. 4.Answer the same question as in requirement 3, but for mirrors.

Correct Answer:

Verified

1.Material-handling cost per speaker:

$7...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$7...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Which of the following is the proper

Q2: Germaine Lotions and Mystic Oils uses a

Q3: Barnett Products manufactures three types of remote-control

Q5: The salaries of a manufacturing plant's management

Q6: Customer profitability analysis is tied closely to:<br>A)just-in-time

Q8: The following tasks are associated with an

Q9: Which of the following statements is (are)

Q10: Rocket Products manufactures three types of remote-control

Q19: One of the important factors when selecting

Q100: Which of the following cost drivers would