Multiple Choice

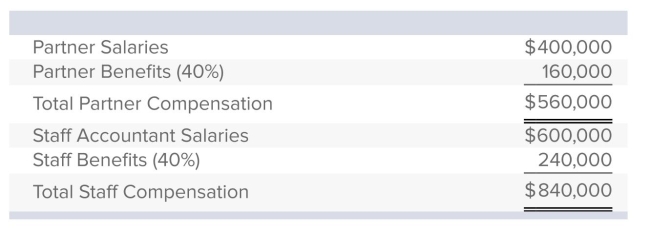

Use the following labor budget data for Roy & Miller Accounting, LLP.  The budgeted overhead cost for the year is $1,260,000.The company has estimated that one-third of the budgeted overhead cost is incurred to support the firm's two partners, and two-thirds goes to support the staff accountants.The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material. If overhead is applied on the Monoco engagement based on two separate cost drivers, what is the cost of the engagement?

The budgeted overhead cost for the year is $1,260,000.The company has estimated that one-third of the budgeted overhead cost is incurred to support the firm's two partners, and two-thirds goes to support the staff accountants.The current audit bid for Monoco Industries requires $18,000 in direct partner professional labor, $30,000 in direct staff accountant professional labor, $5,000 in direct material. If overhead is applied on the Monoco engagement based on two separate cost drivers, what is the cost of the engagement?

A) $101,000

B) $83,000

C) $43,500

D) $96,500

E) $89,000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Farrina Manufacturing uses a predetermined overhead application

Q46: Gonzales Company has developed an integrated system

Q47: Manufacturing overhead:<br>A)includes direct materials, indirect materials, indirect

Q48: Actual costing avoids the profitability of cyclicality.

Q49: Templeton Corporation recently used $75,000 of direct

Q53: When using normal costing, the total production

Q55: Which of the following entities would not

Q76: Osgood Company, which applies overhead at the

Q90: A production order for a job authorizes

Q93: The term "normal costing" refers to the