Multiple Choice

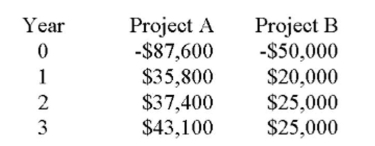

Jackson Traders is considering two mutually exclusive projects with the following cash flows. The crossover rate is _____ and if the required rate is lower than the crossover rate then project _____

Should be accepted.

A) 10.90 percent; A

B) 10.90 percent; B

C) 13.87 percent; B

D) 14.14 percent; A

E) 14.14 percent; B

Correct Answer:

Verified

Correct Answer:

Verified

Q148: The capital budgeting process addresses what products

Q208: Larry's Lanterns is considering a project which

Q209: Given our goals of firm value and

Q210: Profitability index employs some sort of arbitrary

Q211: The following four-year project has an initial

Q212: The crossover point is defined as the

Q214: Hayolom is analyzing a project and has

Q215: Net present value is the preferred method

Q216: The net present value (NPV) rule can

Q217: Which of the following is calculated using