Multiple Choice

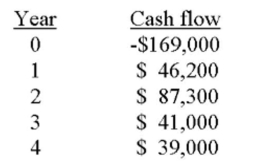

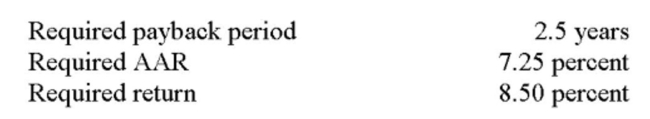

You are analyzing a project and have prepared the following data:

Based on the internal rate of return of _____ for this project, you should _____ the project.

Based on the internal rate of return of _____ for this project, you should _____ the project.

A) 8.95 percent; accept

B) 10.75 percent; accept

C) 8.44 percent; reject

D) 9.67 percent; reject

E) 10.33 percent; reject

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Explain the differences and similarities between NPV

Q290: Assuming that straight line depreciation is used,

Q291: An independent project has conventional cash flows

Q292: The internal rate of return tends to

Q294: A 30 year project is estimated to

Q297: The discount rate that makes the net

Q298: Elderkin & Martin is considering an investment

Q299: Yuliis analyzing the following two mutually exclusive

Q300: The primary idea behind the net present

Q410: NPV and IRR can lead to different