Multiple Choice

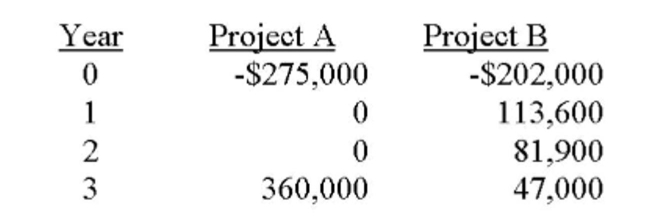

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 percent? What if the discount rate is 10 percent?

A) Accept project A as it always has the higher NPV.

B) Accept project B as it always has the higher NPV.

C) Accept A at 7 percent and B at 10 percent.

D) Accept B at 7 percent and A at 10 percent.

E) Accept A at 7 percent and neither at 10 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q282: Yancy is considering a project which will

Q283: Fora project with conventional cash flows, if

Q284: Project X has a cost of $750

Q285: According to the capital budgeting surveys cited

Q286: The internal rate of return is:<br>A) More

Q288: To find the _ we begin by

Q289: A project has an initial cost of

Q290: Assuming that straight line depreciation is used,

Q291: An independent project has conventional cash flows

Q292: The internal rate of return tends to