Multiple Choice

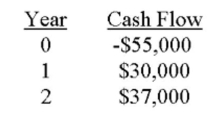

You would like to invest in the following project.  Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 percent discount rate to all cash

Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 percent discount rate to all cash

flows. Based on these criteria, you should:

A) Accept the project because it returns almost $1.22 for every $1 invested.

B) Accept the project because it has a positive PI.

C) Accept the project because the NPV is $2,851.

D) Reject the project because the PI is 1.05.

E) Reject the project because the IRR exceeds 10 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q85: Without using formulas, provide a definition of

Q87: You are considering a project with the

Q88: Your firm's CFO presents you with two

Q91: Corey is considering two projects both of

Q92: If a project has a net present

Q93: Suppose a firm invests $600 in a

Q94: An increased availability of computers and financial

Q95: No matter how many forms of investment

Q128: The process of valuing an investment by

Q235: Would you accept a project which is