Multiple Choice

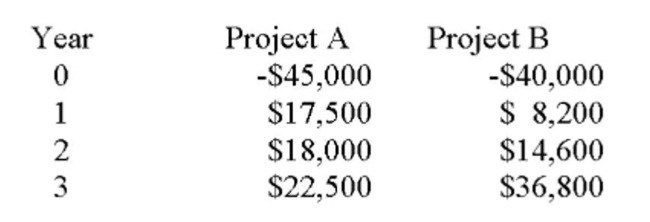

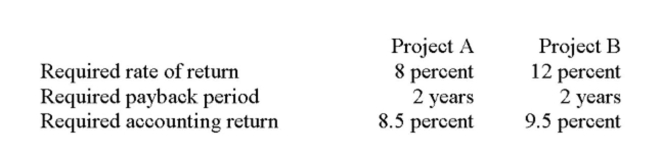

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project _____ because its net present value exceeds that of the other project by

You should accept Project _____ because its net present value exceeds that of the other project by

_____.

A) A; $418.02

B) A; $897.13

C) B; $656.94

D) B; $778.11

E) B; $813.27

Correct Answer:

Verified

Correct Answer:

Verified

Q106: When multiple IRR's exist, a project must

Q220: The internal rate of return method of

Q300: Which capital investment evaluation technique offers the

Q395: Project A has a five-year life and

Q397: You are analyzing a project and have

Q398: If a project has a net present

Q401: You are considering a project with an

Q402: Project A has a five-year life and

Q403: Without using formulas, provide a definition of

Q404: Using the profitability index, which of the