Multiple Choice

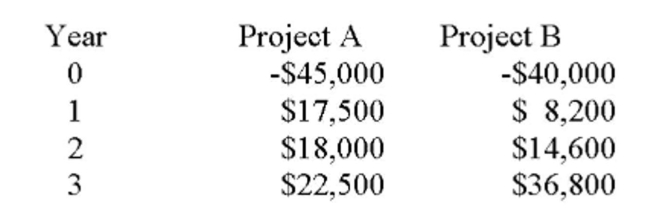

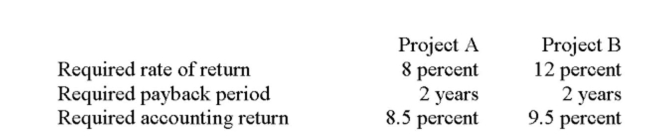

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

A) A; 13.22

B) A; 14.67

C) B; 13.92

D) B; 17.79

E) The IRR should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q113: A firm seeks to accept projects with

Q113: In actual practice, managers frequently use the

Q114: Net present value:<br>A) Cannot be used when

Q115: A project should be accepted when the:<br>A)

Q116: You are considering two independent projects, both

Q117: Calculate the payback of a 20-year project

Q120: An NPV of zero implies that an

Q121: A project has been assigned a required

Q122: A project produces annual net income of

Q343: What is the IRR of an investment