Multiple Choice

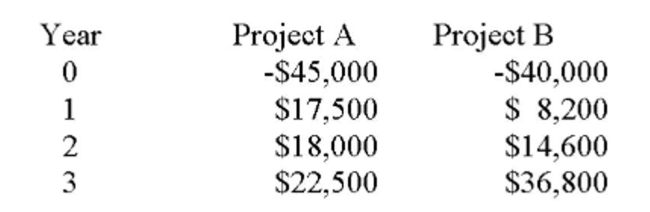

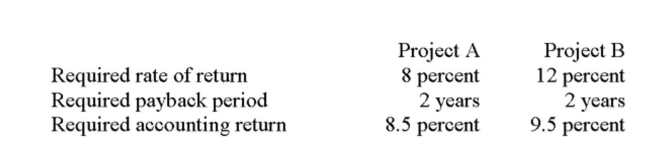

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project ____ because it has the _____ profitability index of the two projects.

You should accept Project ____ because it has the _____ profitability index of the two projects.

A) A; higher

B) A; lower

C) B; higher

D) B; lower

E) The profitability index should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: How does the net present value method

Q91: Corey is considering two projects both of

Q92: If a project has a net present

Q93: Suppose a firm invests $600 in a

Q94: An increased availability of computers and financial

Q95: No matter how many forms of investment

Q97: All else equal, the payback period for

Q98: A project has a required return of

Q99: The profitability index (PI) rule can be

Q100: Sun, Inc. is analyzing two projects. Project