Multiple Choice

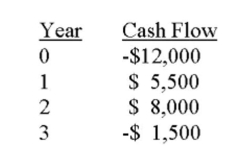

You are considering an investment with the following cash flows. If the required rate of return for this investment is 13.5 percent, should you accept it based solely on the internal rate of return rule?

Why or why not?

A) yes; because the IRR exceeds the required return

B) yes; because the IRR is a positive rate of return

C) no; because the IRR is less than the required return

D) no; because the IRR is a negative rate of return

E) You cannot apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Correct Answer:

Verified

Q245: Use the following mutually exclusive investment cash

Q246: If the required return is zero, then:<br>A)

Q247: The Blue Moon is considering a project

Q248: The payback rule can be best stated

Q249: Without using formulas, provide a definition of

Q251: You run a small bagel shop and

Q252: Without using formulas, provide a definition of

Q253: Peter is considering a project with an

Q254: The difference between the present value of

Q321: The payback period and discounted payback are