Multiple Choice

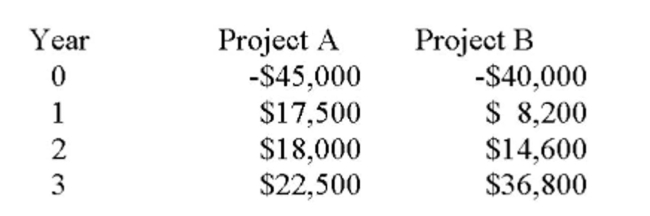

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

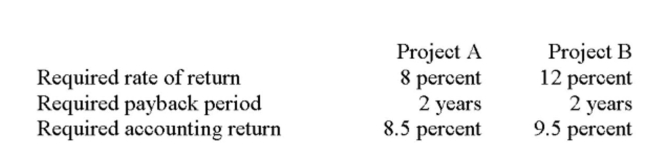

You should _____ Project A and _____ Project B based on the payback period of each project.

You should _____ Project A and _____ Project B based on the payback period of each project.

A) accept; accept

B) accept; reject

C) reject; accept

D) reject; reject

E) The payback method should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The Winston Co. is considering two mutually

Q14: Average accounting return is defined as:<br>A) Average

Q16: Shawn's Health Care is considering a project

Q19: The Jensen Company has compiled the following

Q20: A project has an initial cash outlay

Q21: The average accounting return:<br>A) Reflects the projected

Q22: An investment's average net income divided by

Q23: Annmarie is considering a project which will

Q67: Average accounting return employs some sort of

Q236: An element of the IRR concept is