Multiple Choice

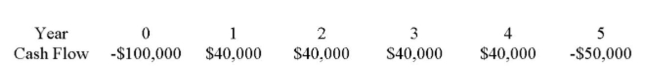

You are considering an investment with the following cash flows. Your required return is 10%, you require a payback of three years and a discounted payback of four years. If your objective is to

Maximize your wealth, should you take this investment?

A) Yes, because the payback is 2.5 years.

B) Yes, because the discounted payback is four years.

C) Yes, because both the payback and the discounted payback are less than two years.

D) No, because the NPV is negative.

E) No, because the project has a large negative cash flow at the end of its life.

Correct Answer:

Verified

Correct Answer:

Verified

Q141: Which of the following is NOT a

Q142: Without using formulas, provide a definition of

Q144: If the required return is 12%, what

Q145: Floyd Clymer is the CFO of Bonavista

Q147: The _ produces a ranking of all

Q148: Bill plans to open a do-it-yourself dog

Q149: Calculate the IRR of a 20-year project

Q150: Floyd Clymer is the CFO of Bonavista

Q151: Which capital investment evaluation technique is described

Q273: The internal rate of return method of