Multiple Choice

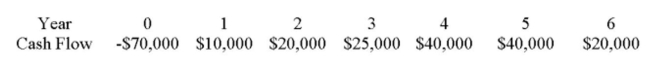

You are considering an investment which has the following cash flows. If you require a four year payback period, should you take the investment?

A) Yes, the payback is 1.000 years.

B) Yes, the payback is 2.675 years.

C) Yes, the payback is 3.375 years.

D) No, the payback is 4.125 years.

E) No, the payback is 5.500 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q102: AAR is biased in favour of liquid

Q180: If a project with conventional cash flows

Q181: The discounted payback rule can be best

Q182: Given that the net present value (NPV)

Q183: An investment's average net income divided by

Q184: Ranking conflicts can arise if one relies

Q186: Without using formulas, provide a definition of

Q188: What is the net present value of

Q190: Which one of the following statements is

Q255: If the internal rate of return on