Multiple Choice

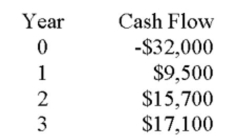

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 14.5 percent? Why or why not?

A) Yes; because the IRR is 14.8 percent.

B) Yes; because the IRR is 14.3 percent.

C) Yes; because the IRR is 13.9 percent.

D) No; because the IRR is 13.9 percent.

E) No; because the IRR is 14.3 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The internal rate of return should:<br>A) Not

Q42: Without using formulas, provide a definition of

Q43: NPV and IRR can lead to different

Q44: A manager will prefer the IRR rule

Q45: If a firm uses the _ as

Q47: The internal rate of return (IRR) is

Q49: A 50- year project has a cost

Q50: Which of the following is true about

Q51: You are going to choose between two

Q173: The internal rate of return method of