Multiple Choice

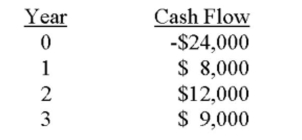

An investment has the following cash flows. Should the project be accepted if it has been assigned

a required return of 9.5 percent? Why or why not?

A) Yes; because the IRR exceeds the required return by about 0.39 percent.

B) Yes; because the IRR is less than the required return by about 3.9 percent.

C) Yes; because the IRR is positive.

D) No; because the IRR exceeds the required return by about 3.9 percent.

E) No; because the IRR is 9.89 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q120: Which of the following decision rules has

Q160: The use of the internal rate of

Q242: Explain why the internal rate of return

Q350: The IRR method can produce multiple rates

Q351: Capital budgeting decisions generally:<br>A) Have long-term effects

Q353: A four-year project has an initial outlay

Q356: The present value created per dollar invested

Q357: Floyd Clymer is the CFO of Bonavista

Q358: Without using formulas, provide a definition of

Q360: Based on the payback rule, which of