Multiple Choice

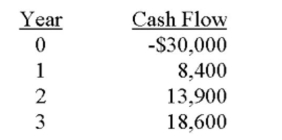

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 14 percent? Why or why not?

A) No; The IRR exceeds the required return by about 1.08 percent.

B) No; The IRR is less than the required return by about 0.97 percent.

C) Yes; The IRR exceeds the required return by about 1.08 percent.

D) Yes; The IRR is less than the required return by about 0.97 percent

E) Yes; The IRR is less than the required return by about 1.08 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: In actual practice, managers frequently use the

Q219: Without using formulas, provide a definition of

Q221: All else constant, the net present value

Q222: A 30 year project is estimated to

Q225: Without using formulas, provide a definition of

Q226: Which of the following is NOT correct?<br>A)

Q227: Payback is frequently used to analyze independent

Q228: You are considering a project that costs

Q229: You have a choice between two mutually

Q331: Lack of consideration of the time value