Multiple Choice

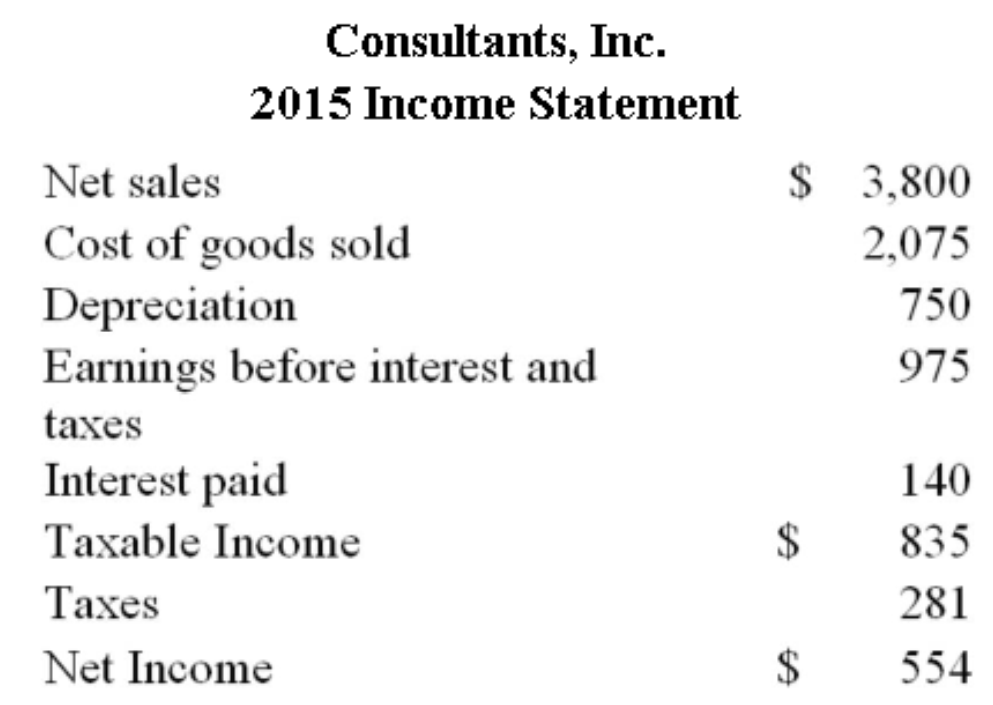

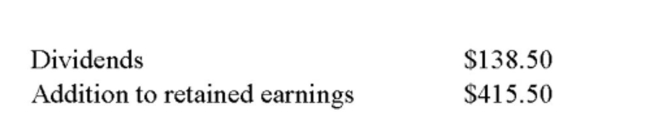

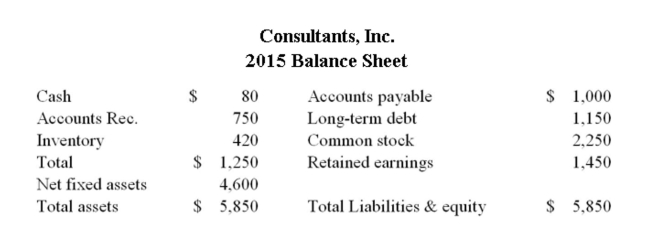

Consultants, Inc. is currently operating at 95% of capacity. What is the required increase in fixed assets if sales are projected to increase by 10%?

Consultants, Inc. is currently operating at 95% of capacity. What is the required increase in fixed assets if sales are projected to increase by 10%?

A) $0

B) $207

C) $230

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q339: The factors are incorporated in the financial

Q340: If your firm is currently operating at

Q341: For financial planning purposes, we generally define

Q342: The following balance sheet and income statement

Q343: The following balance sheet and income statement

Q345: Which of the following statements regarding financial

Q346: With good financial planning, managers can be

Q347: A firm currently has sales of $550,000,

Q348: A firm currently has sales of $1.32

Q349: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2575/.jpg" alt=" Assets,