Multiple Choice

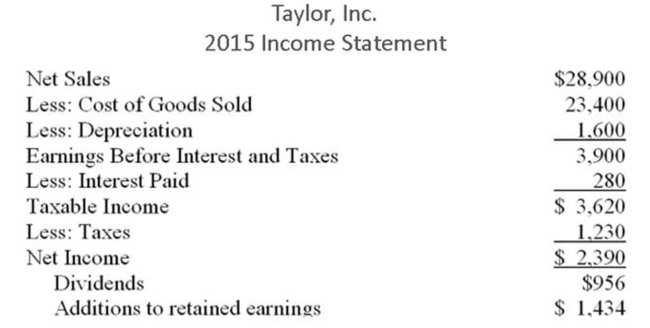

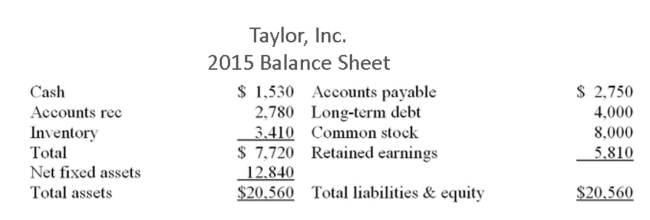

The following balance sheet and income statement should be used:

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are

Assume that Taylor, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are

Constant. What is the projected increase in total assets if sales are projected to increase by 25%?

A) $3,210

B) $3,340

C) $3,690

D) $5,140

E) $5,380

Correct Answer:

Verified

Correct Answer:

Verified

Q120: The following balance sheet and income statement

Q121: Sales growth _.<br>A) Will typically lead to

Q123: Generally speaking, actions that increase the firm's

Q124: One of the primary benefits of aggregation

Q126: It is stated in the text that

Q127: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2575/.jpg" alt=" Assume

Q128: Financial planning is important because the only

Q129: All else equal, a firm that utilizes

Q130: The following balance sheet and income statement

Q153: Calculate payout ratio given the following information: