Multiple Choice

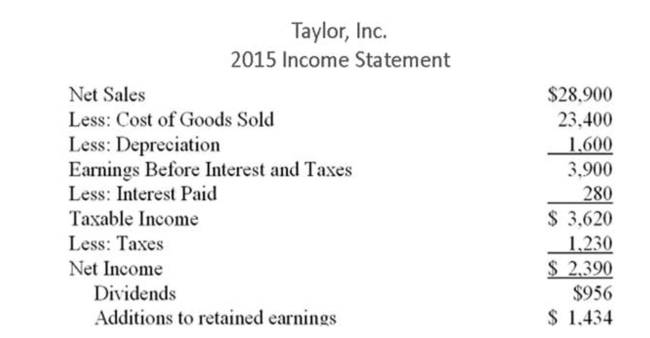

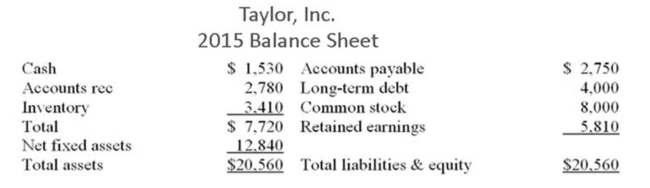

The following balance sheet and income statement should be used:

Assume that all costs, assets, and current liabilities of Taylor, Inc. increase directly with sales. Also assume that the tax rate, the dividend payout ratio and profit margin ratio are constant. The firm is

Assume that all costs, assets, and current liabilities of Taylor, Inc. increase directly with sales. Also assume that the tax rate, the dividend payout ratio and profit margin ratio are constant. The firm is

Currently operating at full capacity. What is the external financing need if sales increase by 8

Percent?

A) -$123.92

B) -$12.87

C) -$9.20

D) $11.68

E) $108.14

Correct Answer:

Verified

Correct Answer:

Verified

Q156: Financial planning helps investigate the linkages between

Q157: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2575/.jpg" alt=" Rondolo,

Q158: All else the same, greater depreciation expense

Q159: Asset requirements is a common element among

Q160: Financial planning, when properly executed:<br>A) Ignores the

Q162: The following balance sheet and income statement

Q163: Which one of the following is the

Q164: Pickup Industries has a profit margin of

Q165: Consider that you are a finance manager,

Q166: One of the primary advantages of financial