Multiple Choice

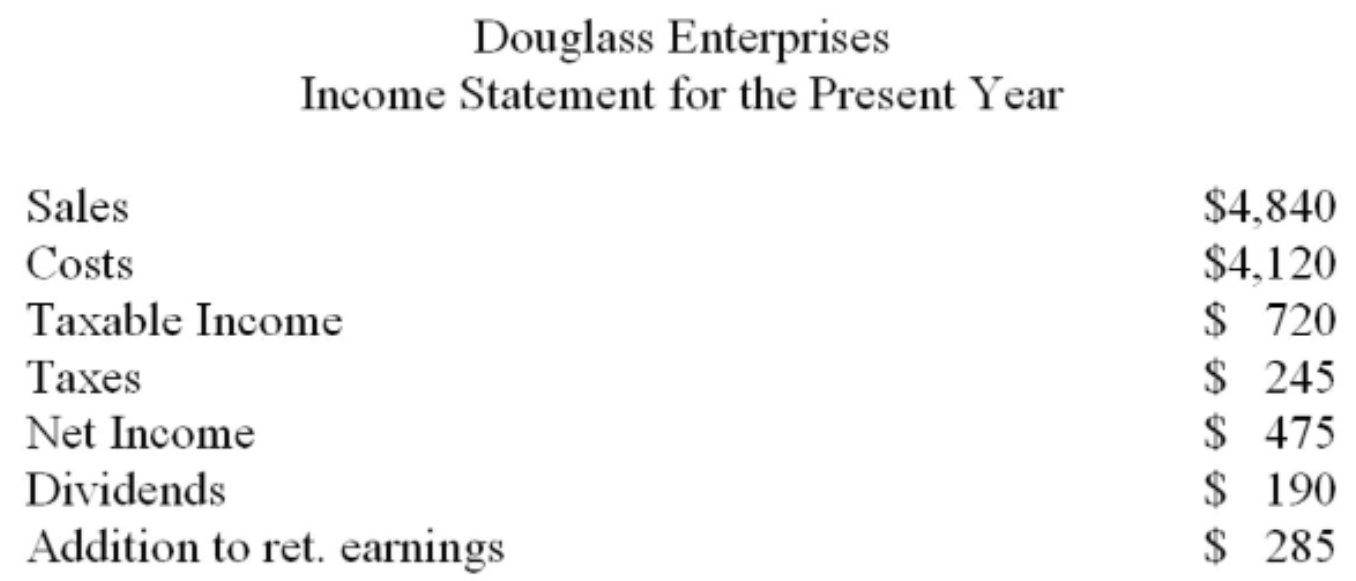

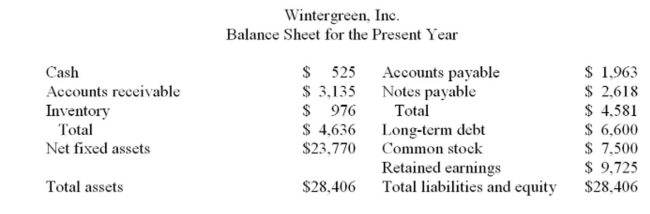

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. Sales of Wintergreen, Inc. are expected to increase by 7% next year. Wintergreen is currently

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. Sales of Wintergreen, Inc. are expected to increase by 7% next year. Wintergreen is currently

Operating at maximum capacity. Wintergreen does not pay a dividend. Given this projection, which

One of the following statements is correct concerning next year's pro forma statement for

Wintergreen Inc. if the percentage of sales approach is used?

A) Costs are projected to be $11,311.

B) Net income is projected to be $1,986.

C) The projected retained earnings is $11,406.

D) The long-term debt is projected to be $7,062.

E) The EFN is projected to be $52.

Correct Answer:

Verified

Correct Answer:

Verified

Q108: Which of the following is NOT a

Q109: When estimating the fixed asset account value

Q110: If a firm lowers its dividend payout

Q112: Tasty Ice Cream has a capital intensity

Q115: Based on the following information, what is

Q116: Provide four factors that affect and influence

Q117: Financial planning:<br>A) Is limited to projecting activities

Q118: Calculate payout ratio given the following information:

Q187: Total assets divided by sales is called

Q195: Calculate payout ratio given the following information: