Multiple Choice

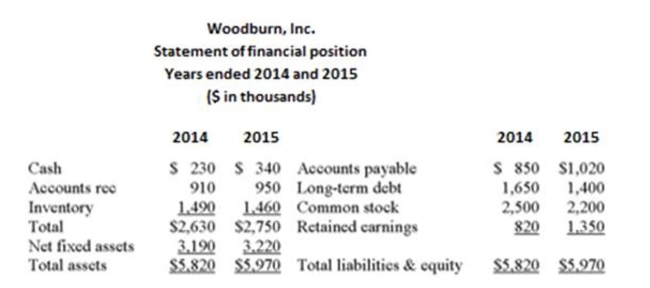

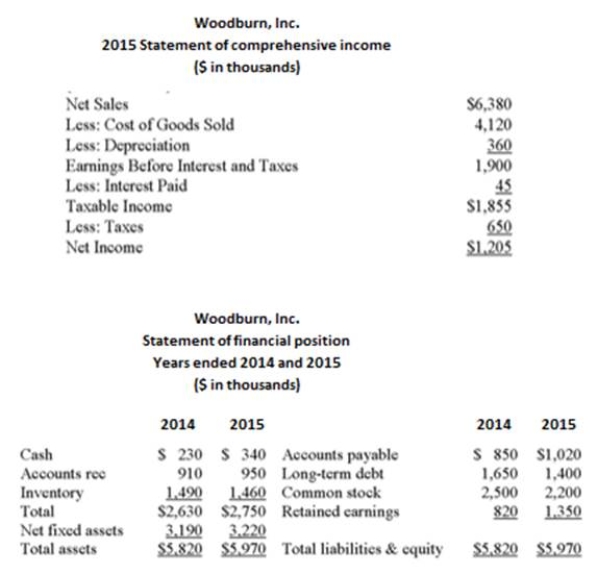

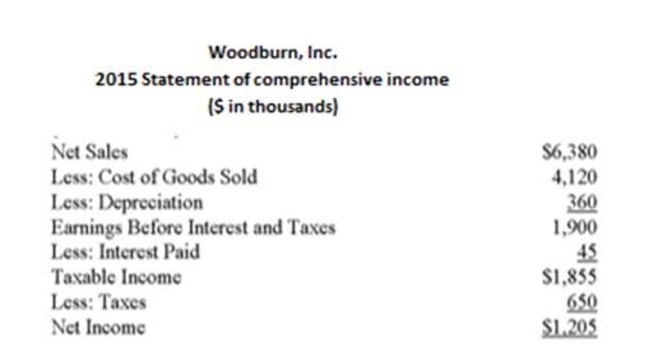

The following statement of financial position and statement of comprehensive income should be used.

Woodburn, Inc. has a profit margin of _____ %, a total asset turnover of _____, an equity multiplier

Woodburn, Inc. has a profit margin of _____ %, a total asset turnover of _____, an equity multiplier

Of _____, and a return on equity of _____ %. (Use 2015 values.)

A) 16.97%; .93; .60; 9.48%

B) 16.97%; 1.07; 1.68; 30.52%

C) 18.89%; 1.21; 1.73; 39.56%

D) 18.89%; 1.07; 1.68; 33.94%

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The inventory turnover ratio is measured as:<br>A)

Q70: The quick ratio is measured as:<br>A) Current

Q134: If a firm is having difficulty controlling

Q135: A firm has a total debt ratio

Q137: In words, what does an equity multiplier

Q140: A source of cash can be defined

Q142: Assume a firm's current ratio equals 3.1.

Q144: Which one of the following measures indicates

Q311: Calculate the value of short-term debt given

Q399: Theodore's Corner Market has a debt-equity ratio