Multiple Choice

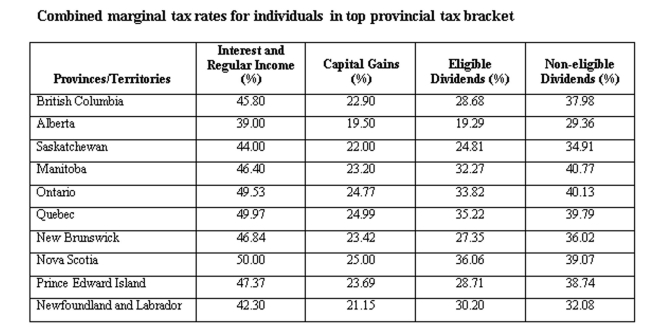

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $1,213.50 more than the Ontario resident.

B) British Columbia resident would pay $1,213.50 less than the Ontario resident.

C) British Columbia resident would pay $1,456.50 more than the Ontario resident.

D) British Columbia resident would pay $1,456.50 less than the Ontario resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q260: Art's Boutique has sales of $640,000 and

Q365: Which one of the following will increase

Q367: _ refers to the net total cash

Q368: BandalCorporation had operating cash flows of $400,

Q369: Cash flow to shareholders is best described

Q371: What is the operating cash flow for

Q372: Which of the following accurately describes the

Q373: Assume a firm has depreciation, taxes, and

Q374: What is a liquid asset and why

Q375: Cantrell Industries spent $386,000 to purchase equipment