Multiple Choice

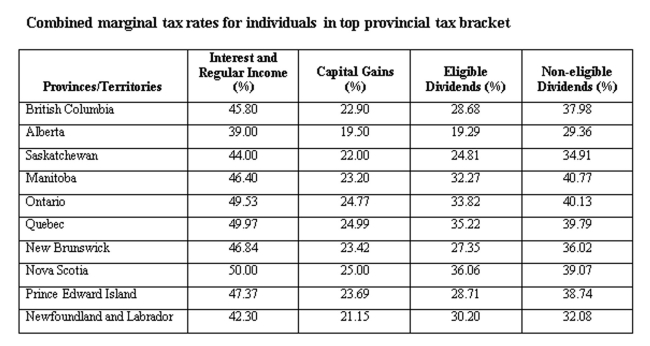

Calculate the tax difference between a British Columbia resident and a Quebec resident both having $20,000 in capital gains and $10,000 in eligible dividends.

A) British Columbia resident would pay $1,072.00 more than the Quebec resident.

B) British Columbia resident would pay $1,072.00 less than the Quebec resident.

C) British Columbia resident would pay $2,502.00 more than the Quebec resident.

D) British Columbia resident would pay $2,502.00 less than the Quebec resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Correct Answer:

Verified

Q168: All else constant, the cash flow to

Q169: Statement of comprehensive income is also referred

Q170: A Quebec resident earned $30,000 in capital

Q171: The difference between a firm's current assets

Q172: _ refers to the cash flow from

Q174: An Alberta resident earned $30,000 in capital

Q175: What is the cash flow from assets

Q176: Calculate earnings before interest and taxes given

Q177: Which of the following is/are true regarding

Q178: Suppose that a firm paid dividends of