Multiple Choice

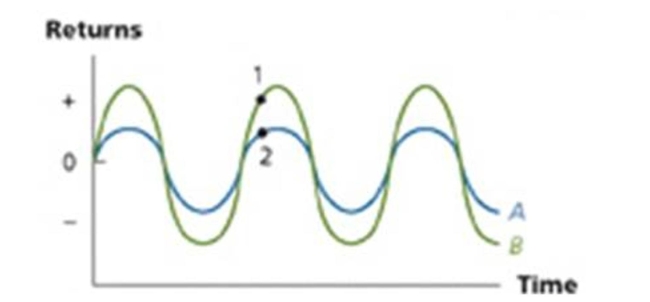

What relationship are the volatilities of stock A and B exhibiting?

A) Positive correlation.

B) Negative correlation

C) No correlation

D) Unsystematic correlation.

E) Systematic correlation.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q68: Market risk premium is needed to estimate

Q107: The stock of Martin Industries has a

Q292: The true risk of any investment is

Q332: You sell some of your Chapters common

Q333: Non-diversifiable risks are those risks you cannot

Q334: What is the standard deviation of a

Q340: Provide a definition for expected return.

Q361: Which of the following is true about

Q365: _ measures total risk.<br>A) The mean.<br>B) Beta.<br>C)

Q386: The stock of Jen's Boutique has a