Multiple Choice

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

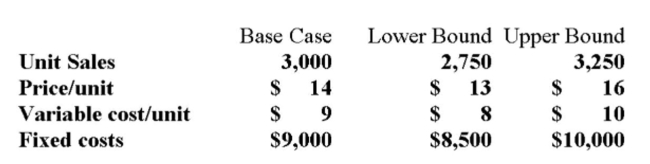

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  Suppose you are interested in the project's sensitivity to unit price. What is the NPV at a price of $13

Suppose you are interested in the project's sensitivity to unit price. What is the NPV at a price of $13

Per unit?

A) -$10,967

B) -$1,029

C) $105

D) $1,868

E) $2,056

Correct Answer:

Verified

Correct Answer:

Verified

Q212: DJ Studios is considering opening a new

Q213: Jupiter Industries manufacturers fishing poles specifically designed

Q214: Wilson's Antiques is considering a project that

Q215: The operating cash flow of a project

Q216: Your company is considering a new project

Q218: All else equal, if you decrease your

Q219: BASIC INFORMATION: A three-year project will cost

Q221: You have put together a set of

Q222: The IRR is equal to the required

Q254: _ analysis combines _ analysis and _