Multiple Choice

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

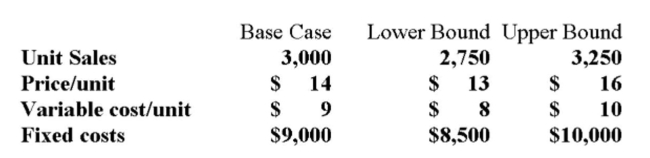

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the best case NPV for the project?

What is the best case NPV for the project?

A) $5,247

B) $26,462

C) $29,306

D) $32,327

E) $34,252

Correct Answer:

Verified

Correct Answer:

Verified

Q50: The accounting break-even point has a net

Q58: The type of analysis that is most

Q277: If a firm's fixed costs are exactly

Q278: In a financial break-even calculation, the project

Q279: The contribution margin must increase as:<br>A) Both

Q280: The Wiltmore Co. would like to add

Q284: Forecasting risk is defined as the:<br>A) Potential

Q285: Sara Lee has noted that every time

Q286: All else the same, if a firm

Q287: Which of the following best describe the