Multiple Choice

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

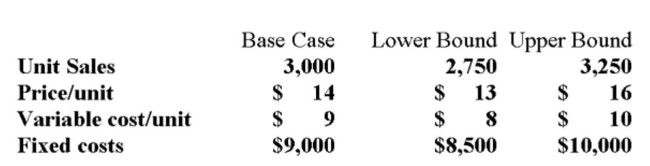

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

A) -$11,594

B) -$10,967

C) -$4,423

D) -$2,327

E) +$3,677

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The type of analysis that is most

Q162: The option to wait may be of

Q193: Which of the following statements is accurate?<br>A)

Q271: The fixed costs of a project are

Q272: All else the same, if you decrease

Q274: In previous chapters, we calculated NPV based

Q277: If a firm's fixed costs are exactly

Q278: In a financial break-even calculation, the project

Q279: The contribution margin must increase as:<br>A) Both

Q280: The Wiltmore Co. would like to add