Multiple Choice

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

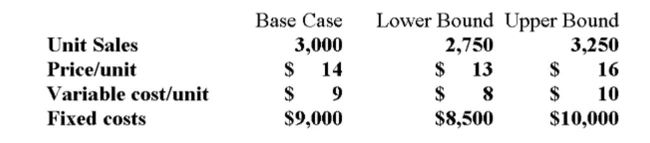

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  What is the base case NPV for the project?

What is the base case NPV for the project?

A) $1,523

B) $4,974

C) $5,247

D) $6,529

E) $8,281

Correct Answer:

Verified

Correct Answer:

Verified

Q48: A project that just breaks even on

Q50: The investment timing decision relates to:<br>A) How

Q51: A firm has fixed costs of $30,000

Q52: Describe briefly each of the three methods

Q55: Given the following information, what is the

Q58: Which one of the following statements concerning

Q126: Projected sales is generally least subject to

Q196: You want to determine how changes in

Q212: If you want to determine the entire

Q407: A project that just breaks even on