Multiple Choice

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings

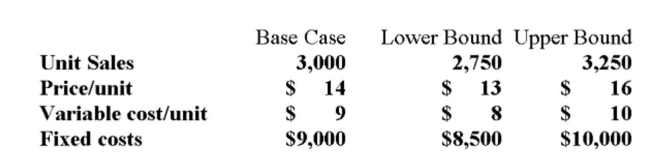

In the year in which the loss occurs. Additional information for variables with forecast error are

Shown below.  Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is

Suppose you want to conduct a sensitivity analysis for the possible changes in unit sales. What is

The IRR when the sales level equals 3,250 units?

A) 32.6%

B) 42.8%

C) 57.9%

D) 118.6%

E) 121.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q72: TD, Inc. is analyzing a new project.

Q73: A project has the following estimated data:

Q75: A firm which is faced with hard

Q77: Fixed costs are generally affected by the

Q78: BASIC INFORMATION: A three-year project will cost

Q79: Which of the following does NOT correctly

Q80: Provide a definition for the term variable

Q331: A group of investors planning to build

Q397: The greater the degree of sensitivity of

Q424: A project that just breaks even on