Multiple Choice

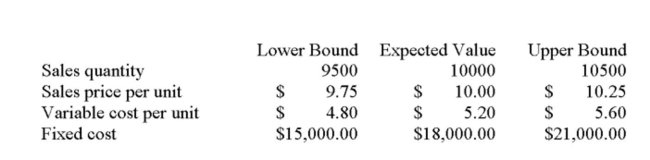

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Initial requirement for equipment: $120,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

The project is operating at the ________ under the base-case scenario.

A) Most profitable level.

B) Accounting break-even level.

C) Point where the IRR is equal to -100%.

D) Financial break-even point.

E) Cash break-even level.

Correct Answer:

Verified

Correct Answer:

Verified

Q163: Describe how the inclusion of a strategic

Q164: Which of the following statements is NOT

Q310: When firms do not have sufficient available

Q311: The financial break-even point is defined as

Q312: At a production level of 11,200 units

Q313: As additional equipment is purchased, the level

Q315: The sales level that results in a

Q316: Costs that can be considered sunk costs

Q317: Donald and Sons manage a product with

Q319: TD, Inc. is analyzing a new project.