Multiple Choice

Julian is a part-time nonexempt employee in Nashville, Tennessee, who earns $21.50 per hour. During the last biweekly pay period he worked 45 hours, 5 of which are considered overtime. He is single with one withholding allowance (use the wage-bracket table) . What is his net pay? (Do not round intermediate

Calculations. Round your final answer to 2 decimal places.)

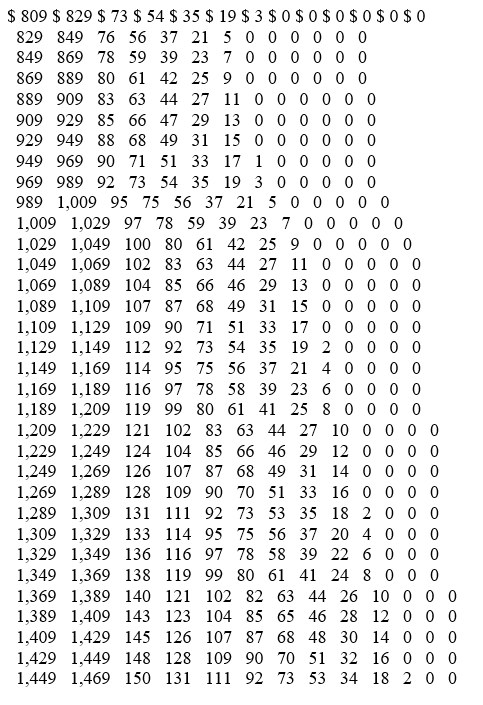

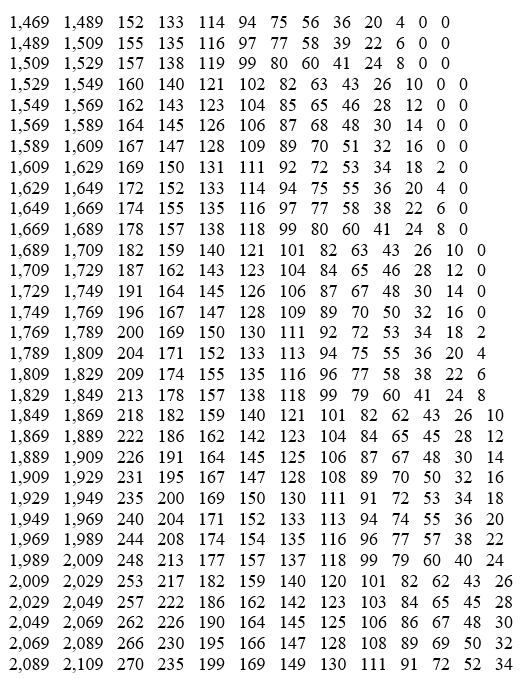

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $865.11

B) $825.99

C) $797.18

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The use of paycards as a means

Q18: The wage-bracket of determining federal tax withholding

Q46: Danny is a full-time exempt employee in

Q47: Olga earned $1,558.00 during the most recent

Q48: The percentage of the Medicare tax withholding

Q51: Jesse is a part-time nonexempt employee in

Q52: Adam is a part-time employee who earned

Q53: Paolo is a part-time security guard for

Q54: The percentage method of determining an employee's

Q55: Disposable income is defined as:<br>A) An employee's