Multiple Choice

Use the information below to answer the following question.

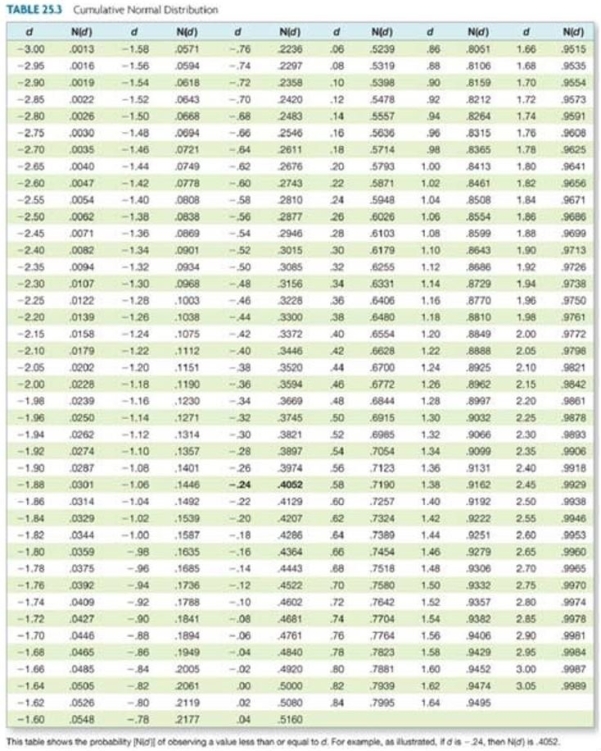

Assume a stock price of $88; risk-free rate of 4 percent per year, compounded continuously; time to maturity of five months; standard deviation of 48 percent per year; and a put and call exercise price of $85. What is the delta of the put option?

A) −.6850

B) −.3742

C) −.3158

D) −.0525

E) −.4685

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The one-year call on TLM stock with

Q42: Which one of the following can be

Q43: Which one of the following statements related

Q44: Which one of these is most equivalent

Q45: WT Foods stock is selling for $38

Q47: Which one of the following statements is

Q48: What is the value of a 6-month

Q49: Which one of the following statements is

Q50: Assume the risk-free rate increases by one

Q51: Under European put-call parity, the present value