Multiple Choice

Use the information below to answer the following question.

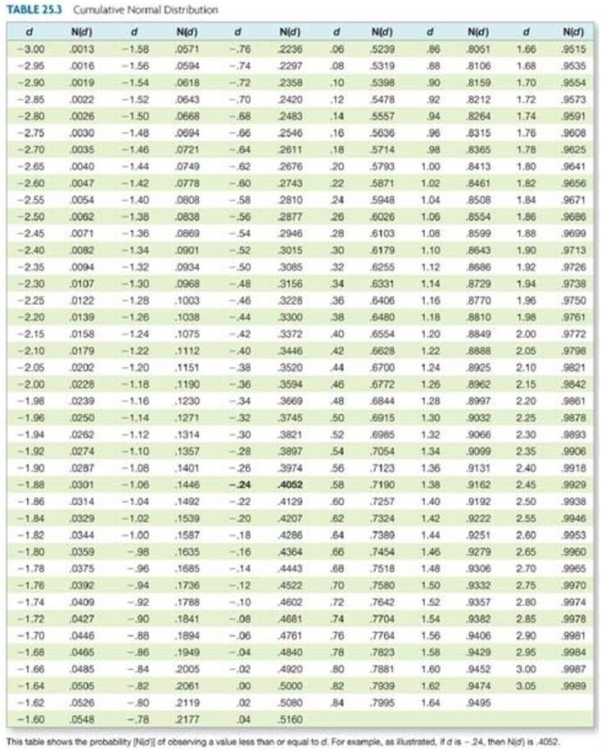

Upside Down has a zero coupon bond issue outstanding with a $10,000 face value that matures in one year. The current market value of the firm's assets is $12,400 while the standard deviation of the returns on those assets is 22 percent annually. The annual risk-free rate is 4.6 percent, compounded continuously. What is the market value of the firm's debt based on the Black-Scholes model?

A) $8,415

B) $8,900

C) $9,413

D) $8,962

E) $9,311

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Which one of the five factors included

Q24: A purely financial merger:<br>A) increases the risk

Q25: Today, you purchased 300 shares of Lazy

Q26: A firm has assets of $16.4 million

Q27: A stock is priced at $52.90 a

Q29: A put option that expires in eight

Q30: All of the following affect the value

Q31: If the risk-free rate is 6.5 percent

Q32: Selling a call option is generally more

Q33: Assume a stock price of $31.18, risk-free