Multiple Choice

Use the information below to answer the following question.

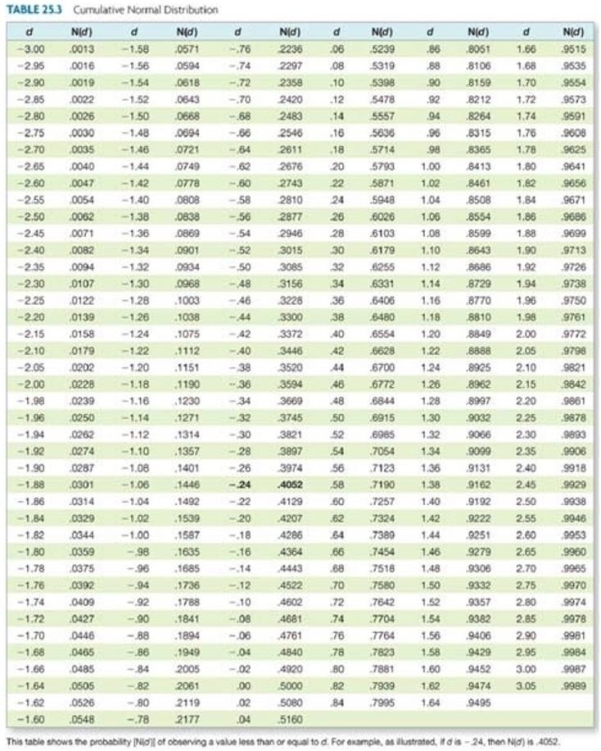

S&C Co. has a zero coupon bond issue outstanding with a face value of $20,000 that matures in one year. The current market value of the firm's assets is $23,000. The standard deviation of the return on the firm's assets is 52 percent per year, and the annual risk-free rate is 6 percent per year, compounded continuously. What is the firm's continuously compounded cost of debt?

A) 11.24 percent

B) 20.32 percent

C) 16.48 percent

D) 18.69 percent

E) 17.09 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q31: If the risk-free rate is 6.5 percent

Q32: Selling a call option is generally more

Q33: Assume a stock price of $31.18, risk-free

Q34: Travis owns a stock that is currently

Q35: The primary purpose of a protective put

Q37: The value of an option is equal

Q38: For the equity of a firm to

Q39: You invest $2,500 today at 5.5 percent,

Q40: Purely financial mergers:<br>A) are beneficial to stockholders.<br>B)

Q41: The one-year call on TLM stock with