Multiple Choice

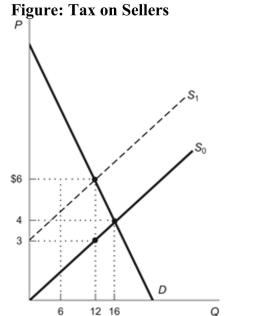

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. The equilibrium quantity sold under the tax is:

Reference: Ref 6-1 (Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. The equilibrium quantity sold under the tax is:

A) 4.

B) 12.

C) 16.

D) 10.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: (Figure: Tax on Consumers of Gadgets) According

Q56: Figure: Wage Subsidy <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt="Figure: Wage

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 6-9

Q60: A market is described by the equations

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 6-3

Q81: Which one of the following statements about

Q98: Which of the following is a correct

Q104: Which of the following statements is correct?<br>A)

Q152: If a tax is imposed on sellers

Q189: Which of the following statements is TRUE?<br>I.