Not Answered

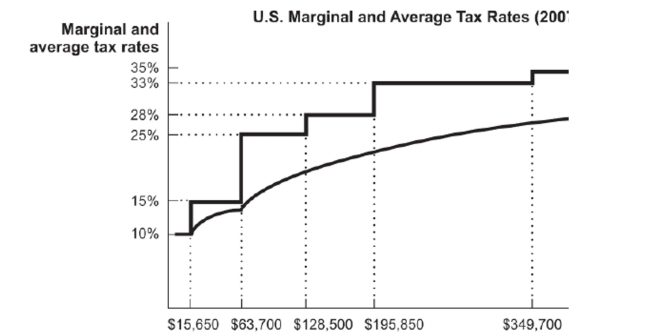

Figure: U.S. Marginal and Average Tax Rates  Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) Using the figure, assume your annual income is $15,000, that you have a deduction of $1,800 for moving expenses, and that you claim four exemptions of $3,300: one for yourself and one for each of your three children. How much taxes are you expected to pay?

A. $132 B. $0 C. $138 D. $120

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Except for the 1990s,the federal deficit has

Q76: Social Security will pay you less if

Q110: Which of the following represents a change

Q112: As income rises,the marginal tax rate for

Q113: What is the Congressional Budget Office's prediction

Q114: Suppose a household has very low income,

Q116: The burden of the corporate income tax

Q118: Compared to the federal individual income tax,

Q119: What percent of the federal budget is

Q152: The largest spending program for the U.S.