Multiple Choice

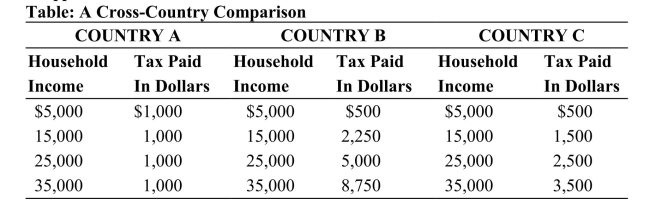

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

A) A and B only

B) B and C only

C) B only

D) None of the countries has it.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The national debt held by the public

Q37: Which of the following statements about the

Q91: What are the arguments for reducing national

Q97: Households in the top 20 percent of

Q106: Income that is not subject to taxation

Q118: Explain the difference between Medicare and Medicaid.

Q130: When a member of Congress adds an

Q133: Because of loopholes and good tax accountants,the

Q141: If the opportunity cost of resources used

Q208: The main income redistribution program that the