Essay

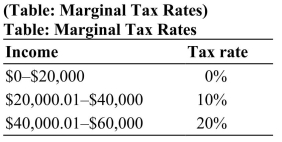

For a family earning $45,000, use the tax rates from the table and determine its marginal tax rate, average tax rate, and total income tax payment. Is this a progressive, regressive, or flat tax code? Explain.

For a family earning $45,000, use the tax rates from the table and determine its marginal tax rate, average tax rate, and total income tax payment. Is this a progressive, regressive, or flat tax code? Explain.

Correct Answer:

Verified

The family earning $45,000 is in the ($4...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: What kind of rising costs will mostly

Q43: Social Security operates on a "pay as

Q54: The Medicare program offers<br>A) health care benefits

Q56: People earning a higher income pay fewer

Q58: The alternative minimum tax has become an

Q61: Using what you know about the U.

Q62: This table shows data on taxes paid

Q63: State and local taxes are about<br>A) 1/5

Q128: It is possible for a country to

Q237: The money you pay into Social Security