Essay

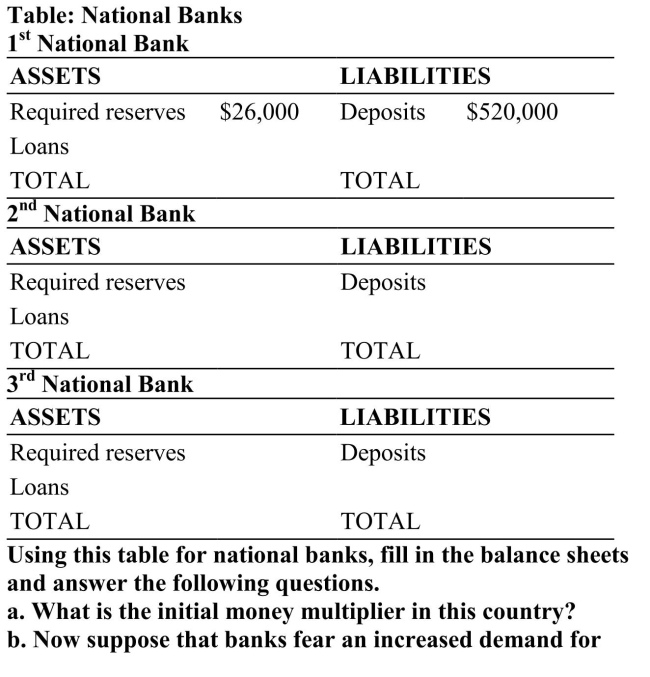

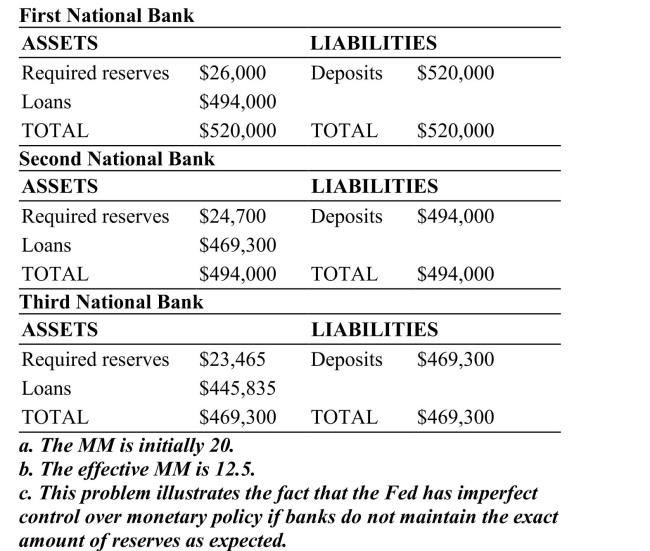

(Table: National Banks) Assume that all banks follow the same required reserve ratio requirement. Also assume that the banks are listed in sequential order (thus the loans from The First National Bank become the deposits for the Second National Bank, and the loans from the Second National Bank become the deposits for the Third National Bank, and so on). Also, the banks' balance sheets must always be balanced.  withdrawals, and thus each bank maintains 3 percent extra deposits as excess reserves over and above required reserves. What is the effective money multiplier now? c. What difficulty associated with monetary policy is illustrated by this question?

withdrawals, and thus each bank maintains 3 percent extra deposits as excess reserves over and above required reserves. What is the effective money multiplier now? c. What difficulty associated with monetary policy is illustrated by this question?

B.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: When the Fed wants to change the

Q19: If the money multiplier is large,then action

Q30: When the Federal Reserve conducts monetary policy,the

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 15-3

Q46: Which of the following is the most

Q51: The major tools that the Fed uses

Q52: Banks retain only a small portion of

Q54: The money multiplier is equal to<br>A) one

Q107: In what ways is the Federal Reserve

Q269: The discount rate is the interest rate:<br>A)