Short Answer

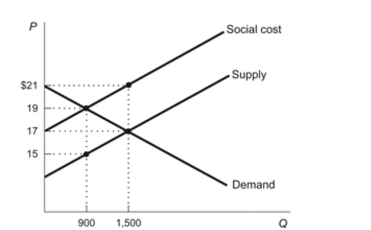

(Figure: Negative Externality) The figure shows the market for a good that causes a negative externality when consumed. The government decides to begin taxing its producers. Using the information provided in the figure, answer the following questions. Figure: Negative Externality  a. What is the market quantity in this market? b. What is the social cost of the product? c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market? d. What is the new efficient quantity in this market after the tax has been imposed?

a. What is the market quantity in this market? b. What is the social cost of the product? c. When the product is taxed, what is the dollar amount of the deadweight loss that is removed from the market? d. What is the new efficient quantity in this market after the tax has been imposed?

Correct Answer:

Verified

a. 1,500 b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: External benefits lead to inefficient market outcomes.

Q74: The text discusses private solutions for resolving

Q101: An external cost is built into the

Q102: Which of the following is an example

Q105: Suppose that the EPA limits the pollution

Q110: All of the following would be government

Q112: Which of the following statements is TRUE?

Q208: Government solutions to externality problems include:<br>A) taxing

Q209: If an external cost is present in

Q219: When external benefits are significant:<br>A) market output