Multiple Choice

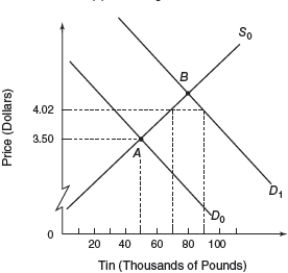

Figure 7.4 Global Market for Tin

-Consider the global market for tin represented by figure 7.4.Initially equilibrium is at point A with a market price of $3.50 per pound and 50,000 pounds.In ordr to keep tin price relatively stable an International Tin Agreement has set a price floor of $3.27 and a ceiling of $4.02.As the demand for tin increases to D1 how will the buffer-stock manager need to respond?

A) buy 10,000 pounds of tin

B) buy 20,000 pounds of tin

C) sell 10,000 pounds of tin

D) sell 20,000 pounds of tin

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Import-substitution policies are supported by the fact

Q76: For developing countries, a key factor underlying

Q93: What is meant by economic integration?

Q111: When a group of countries establish a

Q122: Import substitution is an example of<br>A) an

Q127: To prevent the market price of tin

Q212: Which method has not generally been used

Q213: According to the theory of optimum currency

Q218: The implementation of a common market involves

Q221: When Mexico became a part of NAFTA,along