Multiple Choice

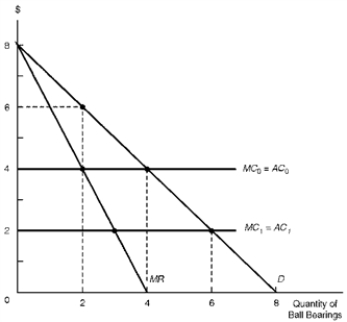

Figure 9.1 illustrates the market conditions facing Sony Company and American Company initially operating as competitors in the domestic ball bearing market.Each firm realizes constant long-run costs,MC0=AC0.

Figure 9.1.International Joint Venture

-Consider Figure 9.1.Suppose that Sony Company and American Company jointly form a new firm,Venture Company,whose ball bearings replace the output sold by the parents in the domestic market.Assuming that Venture Company operates as a monopoly and that its costs equal MC0=AC0,the firm's price,output,and total profit would respectively equal:

A) $6,2 units,$4

B) $4,2 units,$2

C) $6,4 units,$4

D) $4,4 units,$2

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Most vertical foreign investment, as implemented by

Q22: The largest share of U.S.direct investment abroad

Q23: All of the following are potential advantages

Q25: _ would likely oppose policies that permit

Q28: The smallest share of U.S.direct investment abroad

Q29: Figure 9.1 illustrates the market conditions facing

Q30: Figure 9.1 illustrates the market conditions facing

Q31: Concerning the decision by an American to

Q57: In recent years, Canada has virtually closed

Q127: If a joint venture among competing firms