Multiple Choice

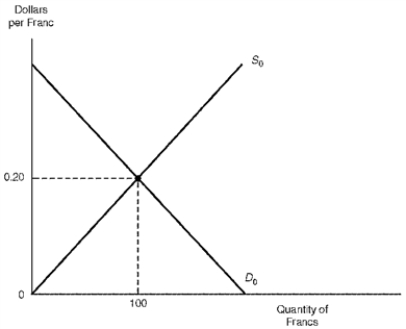

The figure below illustrates the supply and demand schedules of Swiss francs in a market of freely-floating exchange rates.

Figure 12.1 The Market for Francs

-Refer to Figure 12.1.Should preferences for imports rise in the United States and fall in Switzerland,there would occur a (an) :

A) Increase in the demand for francs--decrease in the supply of francs-depreciation of the dollar

B) Increase in the demand for francs--decrease in the supply of francs-appreciation of the dollar

C) Decrease in the demand for francs--decrease in the supply of francs-appreciation of the dollar

D) Decrease in the demand for francs--increase in the supply of francs-depreciation of the dollar

Correct Answer:

Verified

Correct Answer:

Verified

Q23: With floating exchange rates, a country experiencing

Q89: If short-term interest rates rise in Germany,the

Q90: In a free market, the equilibrium exchange

Q90: Given a system of floating exchange rates,if

Q95: Assume that the United States faces an

Q96: Figure 12.3Market for British Pounds<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1889/.jpg"

Q98: If the interest rate in Japan increases

Q99: The U.S.demand for pesos would shift to

Q117: If the Federal Reserve increases interest rates

Q167: Concerning exchange rate forecasting, fundamental analysis involves