Multiple Choice

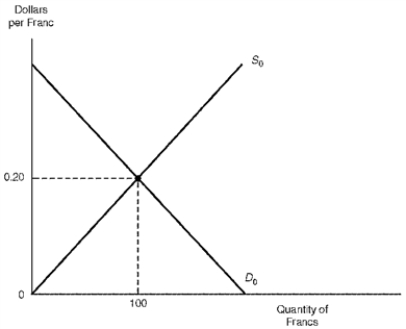

The figure below illustrates the supply and demand schedules of Swiss francs in a market of freely-floating exchange rates.

Figure 12.1 The Market for Francs

-Refer to Figure 12.1.Should real interest rates in the United States rise relative to real interest rates in Switzerland,there would occur a (an) :

A) Increase in the demand for francs--decrease in the supply of francs-depreciation of the dollar

B) Increase in the demand for francs--decrease in the supply of francs-appreciation of the dollar

C) Decrease in the demand for francs--increase in the supply of francs-appreciation of the dollar

D) Decrease in the demand for francs--decrease in the supply of francs-depreciation of the dollar

Correct Answer:

Verified

Correct Answer:

Verified

Q85: In the long run, exchange rates are

Q120: Concerning exchange rate forecasting,_ relies on econometric

Q122: The figure below illustrates the supply and

Q123: In the long run,exchange rates are primarily

Q127: If the exchange rate between Swiss francs

Q128: All of the following are important long-run

Q129: The figure below illustrates the supply and

Q130: Use the following table to answer the

Q133: If the U.S.interest rate rises relative to

Q150: What is exchange rate overshooting?