Multiple Choice

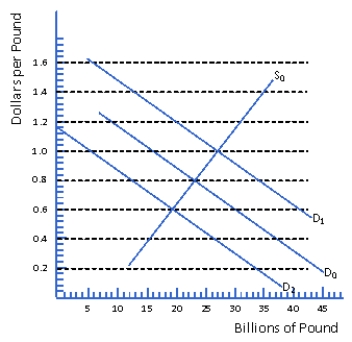

Figure 15.2

Market for the British Pound

-Refer to Figure 15.2.Suppose the demand for pounds increases from D0 to D1.Under a fixed exchange rate system,the U.S.exchange stabilization fund could maintain a fixed exchange rate of $0.80 per pound by:

A) Selling pounds for dollars on the foreign exchange market

B) Selling dollars for pounds on the foreign exchange market

C) Decreasing U.S.exports,thus decreasing the supply of pounds

D) Stimulating U.S.imports,thus increasing the demand for pounds

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Today, special drawing rights (SDRs) represent the

Q49: Figure 15.1 shows the market for the

Q50: The Bretton Woods Agreement of 1944 established

Q51: Exchange rate controls<br>A) Achieved prominence during the

Q52: Under a floating exchange-rate system,if American exports

Q53: The crawling peg is a<br>A) Fixed exchange

Q56: The Australian dollar is currently regarded is

Q57: Suppose Sweden's inflation rate is less than

Q58: Figure 15.1 shows the market for the

Q59: Assume that interest rates in London rise