Multiple Choice

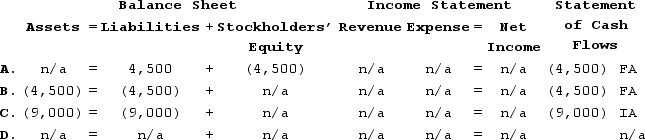

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.Which of the following reflects the financial statement effects on the May 1, Year 1 date of payment?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Chandler Company declared and paid a cash

Q37: Which of the following is a reason

Q38: The Public Company Accounting Oversight Board (PCAOB)

Q42: Gilligan Corporation was established on February 15,

Q43: Van Buren Corporation issued 5,000 shares of

Q44: The corporate charter of Pinkston Corporation

Q45: Chadwick Associates retained $850,000 of net income

Q46: Vortex Corporation has 250,000 shares of common

Q75: The number of shares of stock outstanding

Q129: Liability is a significant disadvantage of the